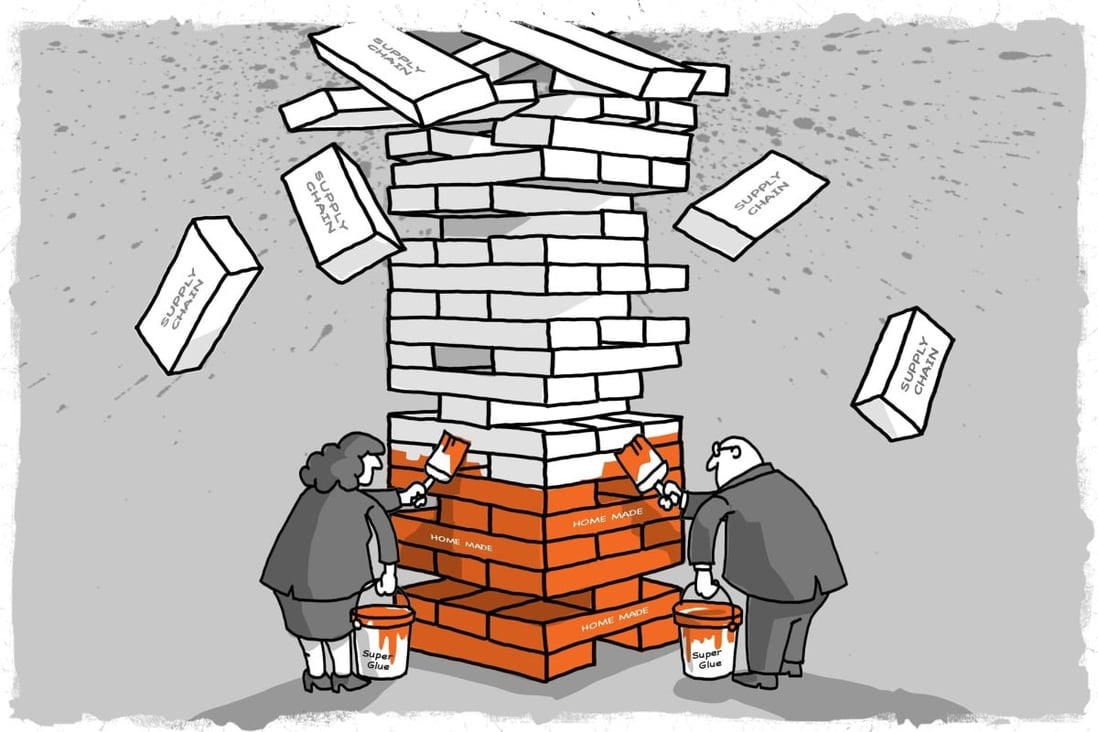

QYK Brands was putting the final touches on its US$5 million medical mask production line in Garden Grove, California, when it hit a snag: export shipments by its Chinese supplier of melt-blown polypropylene – the non-woven mesh that filters out airborne particles – were disrupted by extra inspections. China is its only source of supply, since all of the US fabric production combined can barely meet the needs of the largest face masks manufacturer in the country.

QYK Brands was putting the final touches on its US$5 million medical mask production line in Garden Grove, California, when it hit a snag: export shipments by its Chinese supplier of melt-blown polypropylene – the non-woven mesh that filters out airborne particles – were disrupted by extra inspections. China is its only source of supply, since all of the US fabric production combined can barely meet the needs of the largest face masks manufacturer in the country.

Supplies from Sinopec, China’s largest petrochemical producer and Chinese resellers of its products, trickled almost to a complete stop in early April, as Chinese customs inspectors scrutinized every overseas shipment of medical supplies and devices to ensure they meet export quality and protect China’s global reputation.That forced the three-year-old QYK, whose best-known product is the facial cleansing and massaging gadget QYKSonic, to consider sourcing the material from Russia, or South Korea.

By Peggy Sito and Eric Ng

(This article was first published in South China Morning Post on May 16, 2020.)